China’s trade bottleneck could be worse than Suez Canal

fiasco

There’s currently the mother of all freight traffic jams far exceeding

March’s Suez Canal fiasco. And the impact on Australia could be huge.

When the giant container ship the MV Ever Given wedged itself across the Suez

Canal back in March it quickly captured the world’s imagination.

In an instant, one of the globe’s most important maritime chokepoints was

completely blocked, immediately raising some very challenging questions about

the impact on global supply chains and their vulnerabilities.

But while the Ever Given may have dominated the media headlines and memes

on social media, behind the scenes of global trade an even more impressive,

inspirational event has been brewing.

The MC Ever Given getting stuck in the Suez Canal captured the world’s imagination but also impacted trade.

After tens of trillions of dollars in government stimulus around the globe, the

demand for goods has never been so high. As a result, China’s factories have been

working overtime to produce all the consumer goods households around the world

have purchased with their stimulus funds.

In recent months the virulent Delta variant of Covid has been spreading

throughout parts of southern China, impacting everything from dock workers to

truck drivers.

Put the two together and you have a freight traffic jam of truly epic proportions.

Worse than the Suez Canal disaster

More container loads of freight are being impacted than the entirety of the Suez

Canal blockage. With the Delta strain continuing to impact logistics and shipping,

this backlog may continue to grow despite the best efforts of port officials and

shipping companies.

CEO of Vespucci Marine Lars Jensen said: “From port handling in Yantian (port in

Southern China) alone, the sheer number of containers (not vessels) impacted

now exceed the number of containers impacted in Suez.”

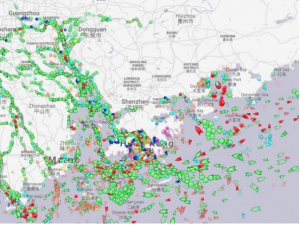

Despite its immense size, the Pearl River delta is currently packed with enormous

container ships waiting for up to two weeks for berths to open up to dock.

According to shipping brokers, there are currently around 160,000 shipping

containers waiting at Yantian alone to be loaded on the dozens of ships currently

waiting at anchor.

Maersk, the world’s largest maritime freight company, advised on Thursday that

64 of its vessels had already skipped scheduled port calls at Yantian and Shekou.

As shipping and logistics companies look for alternative ports to bypass the

Yantian traffic jam, such as Nansha and Hong Kong, there are risks the backlog

could spread to refrigerated freight in these ports due to a limited number of slots

for these types of containers.

“Putting this in context, when Suez was blocked by the Ever Given, it

impacted a daily flow of 55,000 teu. But that ‘only’ lasted six days. In

Yantian, we are at 14 days and counting –and there is the impact on

Nansha and Shekou,” he added.

Meanwhile, global shipping costs continue to rocket higher as a result of

unprecedented demand for both transport and shipping containers.

Shipping costs from Shanghai to Rotterdam (one of the world’s busiest routes)

have increased by over 500 per cent in the past year, to a record high of over

$US10,000 ($A13,000) per 40Ft container.

“Every day increases the backlog of cargo. Once the ports re-open to

normal operations we should expect a surge of cargo – at least to the

degree there are even vessels available to handle this. This in turn will

cause ripples of potential congestion at destinations with a lag time of

some two-to-five weeks.” Ocean carriers are rolling out more rate

increases next week, with FAK rates from Asia to North Europe edging

towards $20,000 per 40ft.

Despite Australia’s relative proximity to China, we have not been immune to

soaring global shipping costs. In the past year the cost of shipping a 40Ft container

from Shanghai to Sydney has doubled to $4307 according to online freight

shipping marketplace Freightos.

As a result of these rising costs, major retailers such as The Reject Shop have

already signalled that they will raise prices.

The Reject Shop has already signalled it will have to raise prices due to increased shipping

costs.

With no end in sight for the current rising supply costs for the nation’s retailers,

The Reject Shop may be just the first of many to pass on those costs to Australian

consumers.

Shipping experts have warned that the current delays would be felt around the

world, rippling through the global supply chain.

Between the impact of potential goods shortages and rising inflationary pressures

from the impact of the backlog of freight in China, Aussie consumers may face

some challenges going forward.

Ongoing price rises may be far more long-lived than many analysts expect. We

may see shortages of goods that are sourced from virus-impacted regions, by

supply imbalances and virus outbreaks in China.